So, today we are talking about what every man needs for a full discharge … and charging.

Best masturbators who work not just as holes but as simulators, texture entertainers, and, to some extent, sex psychologists, are in front of you.Why do we need them:

- To escape from the boredom of weekdays

- To try a new one without causing jealousy from a friend (or wife)

- To get in reality an incredible feeling that we dreamed of from your youth and which you will not get even with the most ingenious partner

- To train working skills (riser, ‘orgasmification,’ endurance, etc.)

- To diversify the games in bed, single and with the best partner

- To present yourself in the company of a skilled adult video actress (perhaps quite a specific one; and we even know who and why)

- To do this with a masturbator of an exciting model (and we think this is the most compelling reason)

Choose a reason for your liking and at the same time, a Fleshlight model for the best wish list. Our list is below.

1. Fleshlight Stamina Training Unit

The ideal thing if you want to diversify male sex life slightly!

If suddenly you wanted something more than your wife’s (or a constant girlfriend’s) pussy texture, you probably shouldn’t go to a dating site or just to a bar, look for a third-party lady (or gentleman). Try to get this Fleshlight model.

Even if you don’t like the experience gained, you will definitely have at least one point in favour of this acquisition. You can relieve sexual tension without any negative consequences for yourself, your family, and your conscience.

And if you like it, even better: you will get an affordable, obedient, and helpful dick simulator.Upgrade your sex skills rationally!

The main advantage of the best (for us) Fleshlight toy is the texture: many-many-many balls of small diameter tightly located next to each other. In complex, they affect the penis so that the stimulation is incredibly intense but not oppressive and unobtrusive.

Nobody forces and does not incite you to come instantly; on the contrary, you stretch pleasure, enjoying the best touches of repeatedly multiplied balls. And you do not notice how you learn to delay the moment of eruption.

Some Fleshlight users, however, believe that the material could be slightly harder, but most are satisfied without it.

You will feel much more powerful and more confident after several Fleshlight texture applications!

There will be no more fear of a sudden unexpected outburst as well as the fear that you will not cope at all.

This best Fleshlight mini sex simulator will help you debug a technique so that you will act better than a jackhammer, only much more gentle and thoughtful. Your girlfriend will appreciate your skills!

What we appreciate the Fleshlight male item for

- 88% realistic by Fleshlight user reviews

- The entrance is thought out anatomically, and it looks pleasant

- Soft but smooth and elastic material from the inside and outside to the touch is very similar to the female ‘surface’

- With the help of a valve that regulates the vacuum level, you can get more and more new sensations and train your endurance

- The best structure of the Fleshlight channel allows you to develop an erection without unnecessary stress with a quickly achieved result: the stimulation is intense but not oppressive; the sensations are extraordinarily unusual and do not contribute to the fact that you are fond of and end up too fast

- Incredibly durable, perfectly stretched, fantastically fits a dick

- There is absolutely no smell

- Thought-out principle of air exhaust

- Ergonomic, comfortable in shape, nice to even take it in hand

- Natural, not flashy, and not annoying colour (and the Fleshlight body colour is also quite nothing, it invigorates and motivates)

- It is simple to care for it: take it out of the case, wash the case and the sleeve, dry them, sprinkle with talcum powder, and bingo!

- Advantageous and straightforward in storage: close the original Fleshlight cover with a lid, and let your mother try to understand that this is not a flashlight (firm’s chip!)

What could be fixed

- Insufficiently diverse internal Fleshlight texture (although the unification corresponds to the initial purpose of the device)

- The Fleshlight channel at the first use may seem excessively narrow (just add a little more lubricant)

This is one of those Fleshlight models that attracted me with their best appearance. No twisted clits to you and wide open, like a gutted fish, labia: on such things, my dick never gets up in principle, they are disgusting. And inside, too, there were no cavities, chambers, streaks, and other perversions, just a collection of ordinary-looking marbles. I thought: hell, why not? It looks quite nice, and I wouldn’t mind putting my dick in there. And you know what? I did not regret it at all. This thing really works as a powerful simulator, which does not exhaust you.”

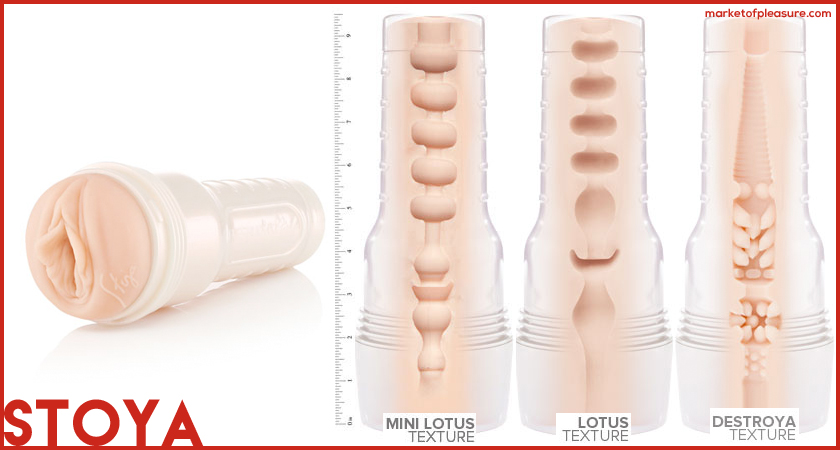

2. Fleshlight Stoya Destroya

It is probably one of the most famous personalized sleeves from the super Fleshlight company. No, in this case, the personalized ones mean not just those that are named in someone’s honour.

Here, everything is more accessible and more explicit: the entrance to the Fleshlight channel with the delicious texture is formed based on the pussy of a particular woman.

For example, the best notorious adult actress, Stoya.

And what is she known for?

This, of course, is up to the amateur. Connoisseurs of modern ero-industry talk about everything in detail in the relevant voluptuous articles. We will say only one thing: Stoya is exceptionally original.

She has no watermelon-like breasts and buttocks as well as long golden curls. But she is incredibly attractive. And her pussy, too.Realistic orchid petals invitingly revealed

And the Fleshlight entrance to inside, although it is clearly outlined, does not remind of a tunnel into which a 19th century locomotive with a smoking pipe can freely enter. The shade is also lovely: a delicate beige-pink, exactly like Destroya’s skin.

Is there any distinctive Fleshlight texture trick?

Of course. Inside, the sleeve is not at all as predictable as the vagina of a woman, even if a masterly erotic actress’ vagina.

- At the entrance, you are best greeted by a short canal, seated with slightly convex hemispheres.

- Then you find yourself in a vast cave, where pointed spears of gentle wide thorns rush at you, tingling and massaging you with incredible zeal.

- And finally (if you get there) you will find yourself in a ribbed tunnel, tickling you even weaker than in previous cameras but no less exciting.

And all this is hidden in a stylish Fleshlight mother-of-pearl case, which, thanks to its corrugated surface, is so convenient to hold in your hands even in the best moments of highest tension.

Why we consider it necessary to recommend this Fleshlight:

- Superbly designed channel texture (360 degrees of decoration)

- Profitable length of the male Fleshlight product (you always have something to best strive for)

- The excellent appearance of an orifice (no rejection, full naturalism), plus the signature of the owner of the prototype

- Stylish design in general

- Compactness

- Low weight

- The highest quality of materials (12 million Fleshlight copies have already been sold worldwide)

- Ease of care, like all Fleshlight products

- When ordering from the manufacturer, for the promotion, there can be obtained a discount mini-version of the lubricant to get pleasure and care liquid bottle for the product

- Quite acceptable, for the author’s Fleshlight products, price

What we don’t like:

- If the appearance of the actress does not attract you, it may affect your psychological well-being when using the realistic Fleshlight product

- The design is classic-Fleshlight: the model does not fit in an ordinary pocket

- Inside, there is no complete realism; the channel has a unique, especially modelled texture and relief

Suitable precisely to represent yourself in company with a woman. Heat in warm water, add grease, and you fly. Particularly contributing to obtaining inexpressible pleasure are changing textures. When the texture of the cameras is about the same, the effect is not at all the same. In short, if you need not only to relieve tension, namely, to create the effect of the presence of a woman, then this model is suitable for 250%. By the way, there is practically no smell from it, and in any case, it does not bring discomfort at all.”

3. Fleshlight Turbo Thrust Blue Ice

It’s the most original Fleshlight thing that can charm you, literally at first sight. Not only does this top best Fleshlight model differ in an unearthly crystal-blue colour, it is also equipped with an extremely non-standard shape of the original and the entrance area as a whole.

It seems to me that it is not at all cool but repulsive!

So it may seem because of promotional Fleshlight photos, in which it is not entirely clear where the body ends, and the penis inlet zone begins.

Compare this Fleshlight Turbo model with other shades, and you will see that an abstract, non-vaginal pussy is an outstanding invention.

Moreover, the primary purpose of this Fleshlight texture product is to give you a blowjob, and not to work at all with a vagina

The specific entrance form, with horizontal and vertical “holes” and gaps, imitates realistic lips. The next chambers are realistic mouth and throat, respectively.

Although you will not find a complete sex analogy with human organs, in fact, it is not required here. It would just ruin everything.

However, due to the specific shape, it is worthwhile to clarify how to clean this Fleshlight model:

- take out the sleeve (i.e. the insertion part that hugs your penis),

- remove the Fleshlight tube from there,

- rinse the texture with warm, clean water,

- dry and collect it in a single set back,

- if necessary, use immediately, without delay: add lubricant, select the realistic vacuum mode, and proceed.

Undoubted advantages:

- developed purposefully to simulate a blowjob (girth by lips + tongue + throat),

- unique Fleshlight entrance (0.4-inch diameter),

- several cameras with an incredibly designed specific texture (diameter is 4/5 inches),

- the best ability to add pleasure through the valve suction,

- medically safe and practical in everyday use (quickly takes the right temperature, is malleable, elastic, soft but durable) silicone-based material,

- unusual Fleshlight appearance (colour creates a sensation of cooling),

- firm compact and convenient design (easy to handle or fasten with foreign objects or special fasteners),

- reasonable price for sex toys at this brand level.

Minor flaws:

- can be used exclusively with water lubricants,

- cannot be washed with ordinary soap,

- cannot be stored in regular polyethylene bags (Fleshlight material features),

- do not use baby powder or talc (according to users).

This thing acts gently. I tried it and another copper-colour model of the same Fleshlight series, and I can say with confidence that I prefer the first version. It’s like giving into the hands and mouth of a sweet, delicate, pretty baby; you know, from those, in lace and gowns. The texture sleeve fits tightly and at the same time neatly. Already at the entrance, when it is necessary to overcome the sweet resistance, impressions are created such that sparks fly from the eyes. In short, I am satisfied. It’s a blowjob goddess packed in clear blue silicone.”

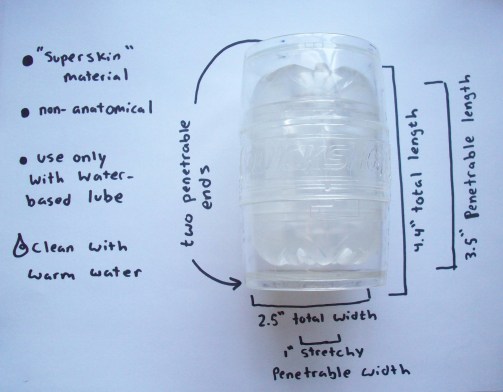

4. Fleshlight Quickshot Vantage

Do you need the best texture toy that can be used in any circumstances, in any position, and in any situation, when it comes to sex? Meet it in front of you.

Universal option

Why did we call this Fleshlight model that way? Because it combines all the necessary qualities:

- Neutral appearance

- The practicality of the internal texture

- Mobility due to compactness

- Convenient shape

It doesn’t matter if you make love alone, with a girl, with a guy or with several partners. In your games, there is always a place for this best Fleshlight product.

For example, as a massager, in combination with a realistic blowjob performed by a lady, or gentleman, or a Cyber Fleshlight item.

Use it as a main course or seasoning

The inner texture of this Fleshlight toy is powerful circular waves: what you need, if you want to get a charge of sexual freshness, not too hard working with the dick.

Fully entering will not work and not necessary. Massage, at will, the root, head or stem, and even eggs, in general … a variety of the best realistic options is quite large.

Watch your dick sex working

And have fun ‘online,’ just watching the movements of the penis through the transparent walls of the Fleshlight toy.

Why do we think this is awesome Fleshlight gizmo:

- It is incredibly convenient: use any of the two holes

- It is functional: you can enter a dick to such depth as you are comfortable

- It is interesting: you can watch how this Fleshlight model raises your cock

- It is small in size: it is easy to get it out of your pocket at the right time, remove the protective covers, and use it as a tool for auxiliary caresses

- It is extremely durable: best Fleshlight texture silicone bends and stretches in all directions but does not break

- It is medically safe and does not cause allergies

- It is easier to wash it than any other non-through toy

- The price may be a bit high but is acceptable for an upscale miniature toy

But that, unfortunately, it is worse than we would like:

- It can only be used with water-based lubricants (and with a sufficiently large amount of them, each time)

- It cannot be stored in regular polyethylene bags

- You need to get used to its sex features

- It may still seem too small

- Its Fleshlight relief is also distinct

- Yes, not everyone wants to look at his penis, floating in a thick spacesuit

I used this tricky-dude when I wanted to try something new. I love tough, very touchable textures, but here, you can also observe how they work with your dick. It is a bit unusual but brings a buzz. It is only important to add more lubricant so that the cock flies inside like a skeleton racer. I want to show it my girlfriend; I don’t think she will be against it, because this is not a cheap vagina with a clit exposed, but a stylish and hygienic thing.”

5. Fleshlight Riley Reid

One of the best Fleshlight texture models created based on the cast of an outstanding erotic actress.

But inside, it is not the same as a real woman!

And this is precisely what this series of Fleshlight pseudo flashlights is good for.

The channel of each of the top versions of such best Fleshlight masturbators is much longer than the vagina of an ordinary woman and is full of surprises.

- First, you find yourself in a cone-shaped chamber covered with ribs from the inside (‘pussy’)

- Then there is a cylindrical compartment (‘vagina’) full of long, spiky texture protrusions biting from all sides

- At this stage, if you move further, you have to overcome the ‘cervix’: an exhilarating feeling and a desirable obstacle, according to reviews of some users

- Farther down, there are spiral grooves seated with sensual palpi

- And finally, if you have enough courage (or rather, length), you will fall into the Fleshlight brand chamber, gently stroking you with circular projections

However, it is not necessary to overcome such several obstacles

You can remove the Fleshlight texture sleeve from the case and enter it from the back side.

So even those who are afraid to check their dick for the presence or lack of the proper number of inches can reach the peak of sex tenderness.And all this you get for a very reasonable price!

Thus, several pleasant advantages of this Fleshlight model:

- excellent imitation of the “internal structure” of a woman,

- gentle and soft, perfectly heat-retaining material,

- an opportunity to adjust the density of compression (valve for vacuum in the back of the Fleshlight toy),

- fantastic, 101% naturalistic orifice (Riley, your neat and not-worn pussy is just brilliant!),

- soft pink tint,

- hypoallergenic, medically “clean,”

- easy to wash.

The user-noticed faults:

- the orifice is denser than you would like to input into,

- the texture camera, compared to it, is much more spacious,

- does not have any unique properties regarding the achievement of orgasm,

- more suitable for sex exercise than actually for pleasure (the Fleshlight material does not stretch, each time the use seems chronologically first),

- requires pre-heating in water or on a heater,

- Fleshlight vacuum cap slightly dangles,

- could be cheaper.

The most interesting thing is that my ex came across this Fleshlight model. She jabbed a finger at the monitor and said: here, this is for you, you son of a bitch! Then she slammed the door, and I looked at what she meant. Generally speaking, the girl on the promo photo really was like her. And I decided to buy this masturbator. Damn, why not? For that amount of money, it should suck like a goddamn god of sex! And it works better than my ex. I do not believe that I say this, but thank you, bitch.”

Fleshlight and other questions

Why do I need this if I can completely satisfy myself? My hand is always with me

We readily believe and do not insist that everyone necessarily try one of the above Fleshlight options.

But still, why not just to say to yourself “dude, maybe you want some unusual sensations? Come on, try, this is not dangerous?”

Skillful Fleshlight masturbators with high-quality texture sleeves can create something that the hand will never give out (let it be three times obedient and familiar to the last millimeter – nope, the result is written above).

Sucking, pinching, scrolling, keeping you in shape, even when the act ended: they know how to do all this. And you can believe us, the Fleshlight based orgasms from this are best and genuinely fantastic.I think masturbators can never imitate a woman’s vagina entirely

You did not try to work with a truly modern Fleshlight sex device. It doesn’t even have to possess a vibro engine with 12 modes and 45 speeds. Some of them, for example, have inlets – 100% of copies of female vaginas (we have considered such models in the Fleshlight review above).

You’d be surprised, but these are, as a rule, charming “flowers” with gently coloured and delicately half-opened sex petals. Compare them with rough crafts, from the inside of which, a lumpy clitoris falls … but who can do it with them?!

Fleshlight surprises are waiting for you inside, too: in particular, we looked at a model above, in shape, resembling a device stolen from a UFO spaceship, but in fact, it perfectly imitates the structure of the mouth and’ larynx.’ Thus, this Fleshlight thing can make you a blowjob no less skillful than a real girl.

The problem is that even the most well-bred and health-conscious girl has a massive number of bacteria in her mouth (with men, there is the same story …it is a feature of Homo sapiens). There will be no such problems with the silicone Fleshlight model.

Unless, of course, you take care of it as follows, following the directions of the manufacturer and common sense.

And finally: no one forbids you to order a Fleshlight toy with an orifice, which is made like an anus: a male anus (belonging to a specific man perhaps), a female one (belonging to a particular woman) or an abstract one.

And something tells us that such a Fleshlight toy will not disappoint you during the stimulation. At least, after the end of use, you can hardly throw it into a corner with an exclamation “what a crap!”

There is a factor that holds me back: I think it’s outrageous, dirty and shameful

We are not going to dissuade you in any way. You should not do what you do not like. But many men believe that only “hand-made sex” is dirty, and the use of special (Fleshlight) accessories for sex stress relief cannot be described as such.

After all, someone specially created this thing so that you could be discharged, which means there is nothing wrong with that. Try to look at this process from this position, and maybe you change your mind.

Will my girlfriend approve of it?

No one knows this better than you do: after all, everyone chooses his life companion to his taste. However, we can confidently tell you that not only men, as a rule, like to watch girlfriends caressing themselves (it doesn’t matter if they do it with their hands or use foreign objects).

When a man enjoys using a special (Fleshlight) toy, it also looks extremely attractive and noticeably exciting. Indeed, as a result of the observations, the best girl gets an opportunity to assess the aspirations, habits, nuances of the bed behavior, reaction, and skills of the man, to adapt to him and to appease him exactly the way he wants.And then there is such a moment as the desire to avoid adultery. It is much more profitable if a husband engages himself and his dick with a Fleshlight masturbator; after all, in such a case, there is little chance that he will look for a girlfriend.

And the wife can either join the best sex game with the Fleshlight masturbator or even temporarily withdraw, “take a breath,” while the husband will not be either disappointed or dissatisfied.

Solid pluses … if, of course, the wife is temperamental enough in itself and wants to give her husband hot sex.

And do not forget about health security! A Fleshlight item will not give such sex and fun related problems as unplanned pregnancy on the third-party side or sexually transmitted diseases.

I love to dream with the sex amusements …

And rightly so! Is there a little fetish (stimulation feature) for men? The best real women of flesh and blood will not always agree to implement them. But an obedient Fleshlight masturbator, specially made in the form of a realistic body, will allow you to discharge your main instrument, accompanying this process with fascinating, sweetest, pleasant dreams.

At the same time, it will not make extraneous sounds, confusing you, complaining about discomfort, chilling you or stopping you halfway, since “I have already finished, and you still crawl there.”

Will I be pleased? I have a sex phobia: I am afraid to plant myself a thorn in an intimate place or to plant it so deeply that I cannot pull it out …

If you buy toys of the best and excellent quality – for example, those that we recommend in this Fleshlight article – then you have nothing to fear.

The materials used for internal Fleshlight inserts not only thoroughly imitate the properties of the human body, but also devoid of almost any shortcomings. Holes, gaps, burrs, irregularities, scuffs: you will not see them either in the Fleshlight internal channels or on external surfaces.

About the too tight Fleshlight channel, well, do not worry:

- Most high-end toys are equipped with valves that allow you to adjust the tension force; if you think that you are “sucked in,” loosen the Fleshlight valve, and you can safely pull your dick out

- If, when buying a new Fleshlight model, you find that it is too narrow so that you can hardly use it for its intended purpose and at the same time feel pain and other discomforts – try to hold it for several hours (or even a day) in hot water by inserting something else. It may help increase the diameter

- If, already in the process of best sex working with a Fleshlight masturbator, it seems to you that its size does not suit you and you cannot do anything about it, find another copy for yourself

There are a lot of options with different diameters since manufacturers are oriented towards users with different weight and muscle characteristics.

As a rule, a proper manufacturer makes all the best stimulation models being equally high-quality, so do not be afraid that the “sex oversize” will fail in comparison with the model of the “sex standard” size.

Can you somehow combine them with the achievements of progress? Reluctance to engage in ‘manual labour,’ when there are so many smart gadgets around

Of course. Many Fleshlight toys are now equipped not only with vibration and rotation, coupled with breathtaking textures and textures, but also heating/cooling, warm air blowing, fixtures on various surfaces or to devices (tablets, smartphones).

Fleshlight has individual devices that are synchronized with video gadgets, allowing you to have the best sex with music, in a self-created or selected virtual space, with a virtual woman of a specific appearance, etc. Everything with Fleshlight is limited only by the depth of your wallet.

Just do not forget that Fleshlight virtual ideals are easy to get carried away – and in fact, there are real women in the world;)What about camouflage?

This Fleshlight list includes best sex stimulation models that are practical and yet safe from mimicry design. It is enough to close the lid (or two, if the product is two-sided), and all outsiders will think that this is a flashlight lantern in a beautiful case.

Or, perhaps, they won’t guess at all what it is: after all, everyone is used to the fact that toys for men look just like vaginas or asses.

Other best companies go even further and offer customers the means to delight in the form of:

- beer cans,

- shaving foam or deodorant,

- ostrich eggs (oh my God),

- housings from auto parts or oil cans (fuel).

Thus, you will likely be able to purchase a model that not only can satisfy all your requests but will also be appropriate to look on the shelf in your room, matching your best image created for the people around you.

What, about this, scientists say?

Scientists fully support those men who pay attention to sex working with Fleshlight and other masturbators. And those who believe that this is sinful occupation (and not only with Fleshlight toys but with ‘living’ girls and even with official wives) are recommended to reconsider their beliefs.It is proved that the male body is severely suffering from prolonged forced abstinence. Of course, if you want to stick to the post and consciously and voluntarily focus on this effort, there can be no negative.

But if your body does not agree with the fact that it shows celibacy, your mood will start to deteriorate, and your hormones will “jump”, the erection will disappear, and your performance too.

Try to explain to the boss that you do not want to work because you have not fucked a woman! An unpleasant picture, right?

Best Fleshlight masturbators will relieve you of all this safer than a permanent partner or call girl. They need to spend money, time and effort; the Fleshlight masturbator, with all its perfect stimulation, does not need anything other than proper care (15 minutes after each session of love) and a small amount of lubricant as well as cleaning agents.

Moreover, with a Fleshlight masturbator, you do not have to be shy of your supposedly short, crooked or thin penis. In general, having such a sex thing with you is not only pleasant but also useful.

https://www.einarstrayorchestra.com.

https://www.einarstrayorchestra.com.